Effectively handling corporate debt is a critical aspect of sustainable business success. A well-crafted approach can minimize the burden of debt, freeing up resources for investment. Key strategies include diversifying your funding sources, proactively monitoring cash flow, and building healthy relationships with investors. Furthermore, a thorough financial plan is essential for anticipating future requirements.

- Utilizing robust risk management practices can enhance your ability to weather economic fluctuations.

- Consistently evaluating your financing structure allows for adjustments to match with changing market conditions.

- Transparency with stakeholders is critical for cultivating trust and securing favorable terms.

Shutting Down Your Business Responsibly

Closing a business is a difficult process that requires careful planning. Before you dissolve your company, it's essential to address all outstanding fiscal obligations. This includes clearing any liabilities you may have to vendors.

Failing to clear these debts can have severe consequences, including legal issues and damage to your credit.

A comprehensive plan for closing a business should include the following measures:

- Notify your customers, suppliers, and employees in a timely and transparent manner.

- Evaluate your assets and liabilities to determine their value.

- Create a closure plan for your assets.

- Consult with legal and financial professionals to ensure you are adhering all relevant regulations.

By following these recommendations, you can wind down your business responsibly and reduce potential problems.

Debt Relief Solutions

Overwhelmed by growing business debt can result in significant financial stress. Fortunately, various debt resolution options are available to assist entrepreneurs back to financial stability.

Consulting with a financial professional can help you navigate the complexities of debt resolution and determine the best solution for your specific situation. Common approaches include:

- Restructuring with creditors to minimize payments

- Filing for Chapter 11 if other options are unfeasible

- Implementing a comprehensive debt management program

Seeking professional guidance promptly can positively influence the outcome and increase your chances of achieving financial recovery.

Negotiating Business Debt Settlement: Your Rights and Options

Navigating business debt can be a challenging experience. When facing overwhelming financial obligations, exploring options for debt settlement is often necessary. Understanding your rights and the available negotiation strategies can empower you to achieve a favorable outcome.

One crucial step involves communicating with your creditors transparently. Express your financial circumstances and willingness to collaborate. A positive dialogue can pave the way for mutually beneficial arrangements.

Assess seeking professional guidance from a credit counselor. Their expertise can provide valuable insights tailored to your specific circumstances. They can help you analyze the conditions of any settlement offer and negotiate your best interests throughout the process.

Remember, strategic action is essential when dealing with business debt. By understanding your rights and exploring available options, you can navigate this challenging situation effectively and obtain a more manageable financial future.

Tackling Unmanageable Debt: Steps for a Favorable Outcome

Facing overwhelming debt can feel daunting. It's understandable to feel overwhelmed. But don't give up. Taking strategic steps is crucial for achieving a positive outcome. First, thoroughly assess your current situation. Create a in-depth budget to track your income and expenses. This will shed light areas where you can reduce.

Next, explore various debt reduction options. Negotiation programs may assist your burden by lowering your interest rates or monthly payments. Consulting with a financial counselor can provide essential guidance tailored to your specific circumstances. Remember, managing unmanageable debt requires discipline. Keep pushing on your goals and celebrate each victory along the way.

Confronting Business Debt: Effective Solutions for Difficult Situations

Overcoming commercial difficulties can be challenging, especially when debt looms over your enterprise. However, it's crucial to remember Menopause and Inflammation Reduction that you are not alone and there are effective solutions available. A proactive approach involves a thorough analysis of your financial standing.

Creating a sound budget is the first step toward restructuring your debt. This involves identifying areas where outgoings can be cut back. Explore possibilities for negotiating lower interest rates or extending repayment terms with your creditors. Explore secondary funding sources to alleviate the financial burden.

It's often advantageous to seek advice with a credit counselor. These professionals can provide support tailored to your unique circumstances. Remember, confronting business debt head-on with a well-defined plan and commitment is essential for achieving long-term financial health.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Anthony Michael Hall Then & Now!

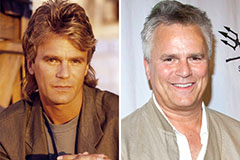

Anthony Michael Hall Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!